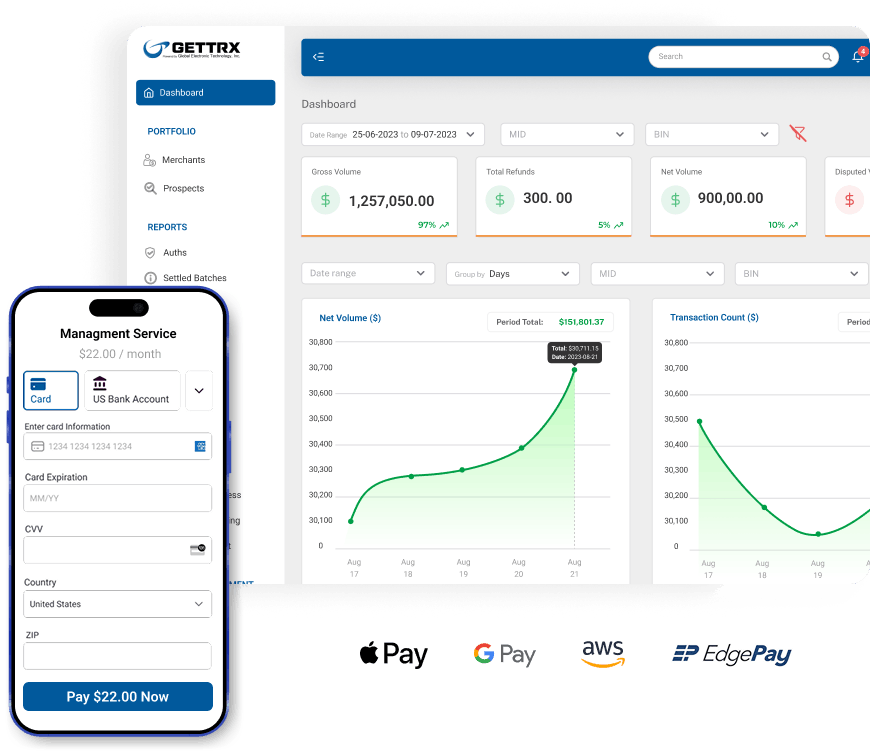

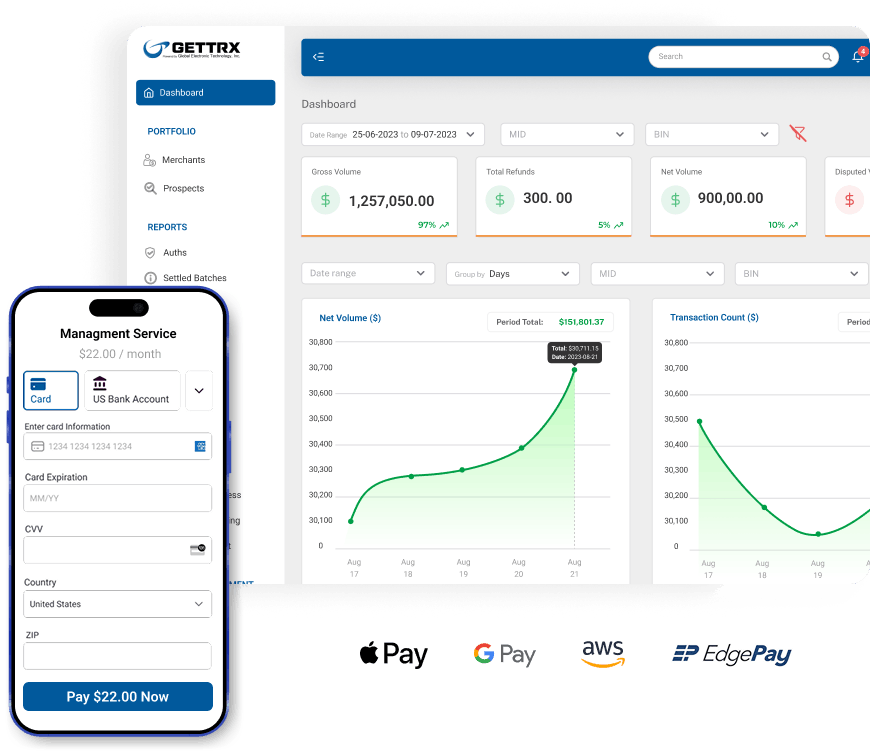

Introducing GETTRX One, a unified payments platform for Merchants, ISVs platforms, and Payment partners.

Credit card & ACH processing, digital payments, and embedded payment capabilities in one solution-covering onboarding, underwriting workflows, payment acceptance, reporting, disputes, and portfolio management.

Merchant services and processing, white-label partner tools, and embedded payments with monetization.

Everything you need to accept payments, manage operations, and stay in control-without juggling disconnected systems.

Integrate embedded payments, monetize transactions, and fully brand the experience-without building payments infrastructure.

Offer a complete, fully white-labeled payments experience under your brand-without building the stack.

Whether you are a Business looking for payment processing, an ISV looking to become a Fintech, or an Agent looking to become a Fintech, GETTRX One has features that will take your business to the next level.

Simple, high-trust flow that supports merchant services, embedded payments, and white-label go-to-market.

Merchants: Sign up online for a merchant account and get immediate access to your payments mission-control dashboard

ISVs & ISOs: Use our whitelabel hosted onboarding or integrate via APIs/SDKs to onboard your merchants in minutes.

Accept card and ACH payments using our virtual or in-person terminals & card readers, payment links, e-commerce plugins, invoicing solutions, and full suite of APIs to meet any integration needs

Centralize reporting, settlements, disputes/chargebacks, deposits, statements, and more.

Get full portfolio oversight across all your merchant accounts, partners, and platforms.

For Merchants

For Merchants

Fill out an application in minutes, and start processing payments immediately through any of our payment processing solutions and e-commerce plugins, with support for your customer's preferred payment methods (Card, ACH, Apple Pay, Google Pay)

Comprehensive analytics and reporting regardless of the gateway, or terminal solution that you are using -- True end to end visibility of your merchant accounts

PCI Compliant Tokenization, advance fraud prevention tools with device fingerprinting and AI, and bank-grade security

For ISVs

For ISVs

Launch payment processing with our embedded payment solutions in days with our no-code hosted payments and onboarding solutions, and comprehensive API suite

N-way split funding, platform fees, partner fees -- Monetize every transaction at the point and time of sale

Complete API suite with SDKs, Webhooks, sandbox environment, and developer playground for rapid integration

For Agents & Resellers

For Agents & Resellers

Become a Fintech without investing millions of dollars and years of development with our fully brandable merchant portals, onboarding flows, payment pages, and APIs -- Operate under your own identity

Single platform for you and your merchants for onboarding, underwriting, payment acceptance, reporting, dispute management, and portfolio management across all segments

Transparent residual reporting and automated payouts for agents and resellers

No Hidden Charges!

Plans that meets your Business Needs

One rate locked in for the lifetime of your account

Starting at

* Restrictions by business type apply

Eliminate up to 100% of your processing fees

Starting at

* Restrictions by business type apply

Expert-led processing statement consultation to find the best pricing program that fits your business

Become a Fintech instantly and start monetizing your payments in days

Call us at: 888.775.1500

CEO and Founder, Ytel

McLeod Racing LLC, President

CMO Primitive Skate

"Forget that GETTRX said they could do the job, and never mind that they saved us both time and money, most important is that my team and I feel we are in the hands of payment processing experts to help us solve challenges and grow our business."

From NHRA drag strips in the U.S. to endurance racing in Europe and Asia, support championship-winning teams that demand absolute precision, reliability, and consistency. That same performance mindset powers our payment infrastructure-built for speed, proven at scale, trusted by global merchants and major sports organizations alike.

Whether you need payment processing, merchant services, embedded payments, or a full-service white-label payments platform, GETTRX One can support your business.

![]() W. 190th St., Ste. 650 Torrance, CA 90502

W. 190th St., Ste. 650 Torrance, CA 90502

![]() Fax: 800.250.8501

Fax: 800.250.8501

![]() Toll-free: 888.775.1500

Toll-free: 888.775.1500

![]() E-mail: info@gettrx.com

E-mail: info@gettrx.com

Global Electronic Technology, Inc. (GETTRX) is a registered ISO/MSP/PSP/Payment Facilitator for Merrick Bank, South Jordan, UT, FDIC insured.

Global Electronic Technology, Inc. (GETTRX) is a registered ISO/MSP/PSP for Esquire Bank, Jericho NY.

Make understanding your ACH codes and transactions easier with GETTRX One