GETTRX’s PayFac-as-a-Service solution is the seamless and simple way for ISVs and SaaS platforms to lower customer acquisition costs, boost lifetime values, and increase customer engagement.

Ready to Solve

Payments for

Your Customers?

PayFac-as-a-Service helps you hit the ground running and quickly onboard customers while adhering to compliance standards. GETTRX absorbs the stress of fraud monitoring and compliance reporting while you focus on your business.

Lean on our payments expertise and offer your customers an end-to-end solution.

PayFac as a Service

Seamless Solution

Integrate payment acceptance with the rest of your platform and offer your customers a complete product suite. You’ll boost customer lifetime values and engagement.

Instant Payment Facilitation

Eliminate lengthy approval times and onboard your customers almost instantly. As a submerchant, you’ll avoid dealing with tedious merchant account application procedures.

Cost Efficient

Avoid installing costly payments infrastructure or platform upgrades. With PayFac-as-a-Service, you receive an instant upgrade to payments best practices. Focus on your core business and leave payments to the experts.

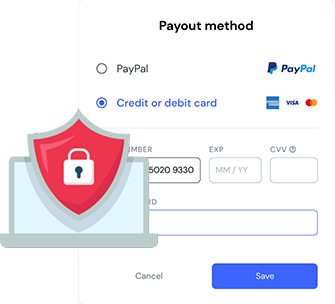

Out-Of-The Box Payments Compliance

AML, KYC, fraud monitoring. Payments compliance needs are endless. Instantly upgrade your payments module and become PCI compliant.

A Guide to Payment Facilitation

Check out our guide to payment facilitation and what it means for your business.

PayFac-as-a-Service Versus Becoming Your Own Payment Facilitator

Learn why PayFac-as-a-Service solutions might suit your business’ needs better.

Why Payment Facilitation as a

Service With GETTRX?

Experience

Over 30 years in the payments business and $15 billion processed. It’s safe to say we understand payments inside and out.

With GETTRX’s PayFac-as-a-Service solution, your customers receive seamless signups while you leverage payments as a revenue strategy. We’ll show you how.

Fully Owned Technology

We own our infrastructure and technology. Experience full transparency and peace of mind.

GETTRX’s PayFac-as-a-Service solution is built to simplify payments compliance and reduce implementation costs.

Your Trusted Partner

Plug in and experience seamless payment facilitation that boosts your revenues with a simple fee structure.

GETTRX will help you implement unique revenue monetization models that deliver customer value and enhance your brand.

Build New Revenue Streams

Boost your revenues by monetizing payments. GETTRX will help you design payments pricing models that increase cash flow and boost sales.

Own Your CX

Control your customers’ experience with GETTRX’s PayFac-as-a-Service solution.

From payout timing to payment acceptance pricing, give your customers an experience they’ll remember.

Developer-Friendly APIs

Leverage our PayFac-as-a-Service solution to begin offering payment acceptance to your clients in a few days.

GETTRX adapts to your needs and offers highly customizable solutions that easily integrate with your systems.

Seamless Payment Facilitation

Get up and running almost instantly

Multiple Use Cases

– Card on File

– Account Updater

– Split Payments

– Recurring Transactions

– Level 2 and 3 Transactions

– and so much more!

Easy Compliance

– Full Tokenization with Developer SDKs

– Fraud Detection

– Automated KYC and AML Norms

– Transaction Monitoring

Experience

– Over 30 Years in the Payments Business

– $15 Billion in Transactions Processed

– Developer-Friendly Infrastructure

– Your Trusted Payment Facilitation Partner

Blog

Frequently Asked Questions

What is PayFac-as-a-Service?

Payment Facilitation as a Service or PayFac-as-a-Service enables software platforms to monetize payments and onboard new users instantly. The platform functions as a master merchant account that can be used to set up sub-accounts for end users immediately.

Why is Payment facilitation as a service the best choice for my platform?

With Payment facilitation as a service, you can avoid the hassle of applying for merchant accounts and waiting for time-consuming approvals. Onboard your customers instantly and offer payments out-of-the-box with GETTRX’s PayFac-as-a-Service solution.

Does GETTRX white-label another platform’s technology?

We fully own our technology and do not white label any part of our solution from alternative providers. We believe in full transparency. We have been in the payments business for over 30 years and you can lean on our expertise to build a complete product suite your customers will love.

Which payments use cases does GETTRX’s platform support?

Our platform supports the following use case, amongst others:

- Card on file

- Account updater

- Split payments

- Recurring transactions

- Level 2 and 3 transactions

- Full tokenization

How can I monetize payments on my platform?

GETTRX’s PayFac-as-a-Service is much more than just a technological solution. We are your trusted payments partner and will help you unlock additional revenue streams. We will help you design profitable cost structures and advise you on what works and what doesn’t.

How do you handle compliance reporting?

Our PayFac-as-a-Service solution helps you become PCI compliant from Day One. You can access in-depth reporting and payment analytics using our technology and avoid absorbing compliance costs. You control your data and we will give you the tools to help you analyze it.