GETTRX One: Our Breakthrough Digital Payments Platform

Our Comprehensive Payment Platform Simplifies Merchant Reporting and Analytics While Giving You More Control Over…

years in business

in processing volume

merchants serviced

Uptime

A payment platform that can fit your needs and drive your goals forward.

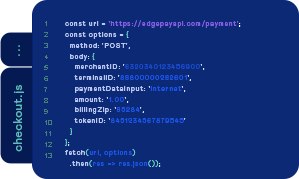

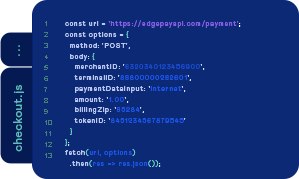

A developer-friendly payment

infrastructure that empowers your platform with an impressively simple API.

Whether you want to grow your

residuals full time to earn a CEO-level salary or earn money on the side to your existing income, GETTRX has the best agent commission schedule to help you get there.

Because every business is different, GETTRX offers POS options that can be customized to support your unique needs. Whether you’re selling goods, booking appointments, or creating an optimal checkout experience, our versatile point-of-sale software and top-tier payment terminals empower you to lead your business into the future.

Streamline the donation and fundraising process with our comprehensive non-profit platform, Cauzing. Whether you’re keeping track of multiple causes, campaigning via phone, mail or online, or accepting recurring payments, GETTRX can help drive more donations on one simplified platform.

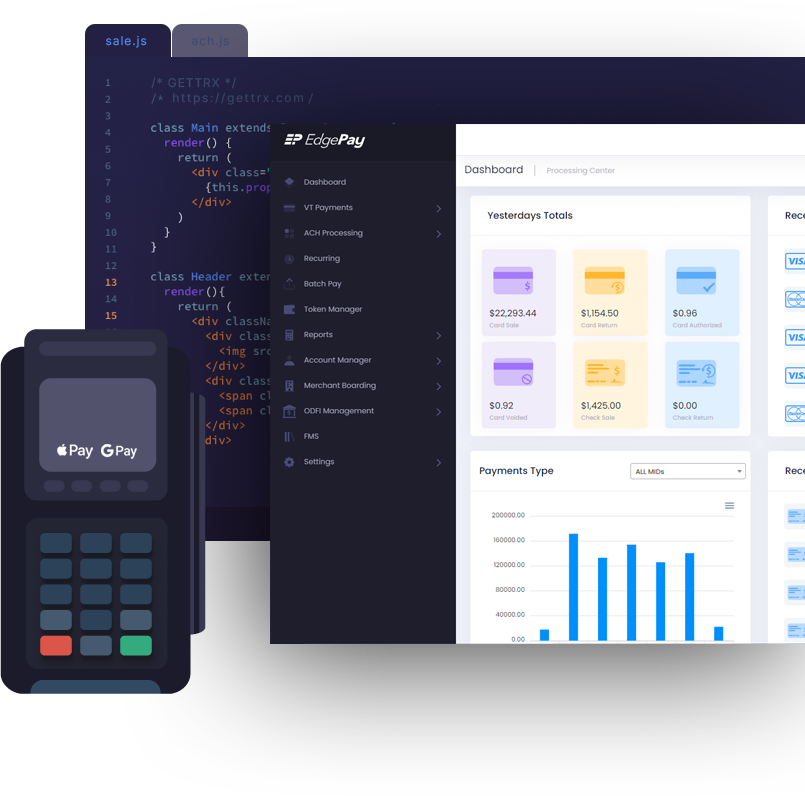

Securely process all your transactions through GETTRX’s best-in-class gateway, EdgePay. Our software allows you to manage security, and choose the right integration for your business, whether you have an online shop or a full eCommerce platform.

From real-time onboarding to flexible pay outs, we supply ready to use integrations and modern tools to start accepting payments in your platform within minutes. GETTRX provides solutions to reduce your compliance requirements, easy to integrate functionality, and adaptable options that elevate your customer experience.

Because every business is different, GETTRX offers POS options that can be customized to support your unique needs. Whether you’re selling goods, booking appointments, or creating an optimal checkout experience, our versatile point-of-sale software and top-tier payment terminals empower you to lead your business into the future.

Securely process all your transactions through GETTRX’s best-in-class gateway, EdgePay. Our software allows you to manage security, and choose the right integration for your business, whether you have an online shop or a full eCommerce platform.

Streamline the donation and fundraising process with our comprehensive non-profit platform, Cauzing. Whether you’re keeping track of multiple causes, campaigning via phone, mail or online, or accepting recurring payments, GETTRX can help drive more donations on one simplified platform.

From real-time onboarding to flexible pay outs, we supply ready to use integrations and modern tools to start accepting payments in your platform within minutes. GETTRX provides solutions to reduce your compliance requirements, easy to integrate functionality, and adaptable options that elevate your customer experience.

Eliminate 100% of your

processing fees

Per Month

One rate locked in for the lifetime

of your account

Per Item

(monthly)

Sales Volume (monthly)

0.00%

2.75% + 30¢

$29.00

$1,500.00

$1,481.00

$0

GETTRX offers transparent billing and competitive rates, all backed by the industry’s best customer service! We approach each customer relationship with the same degree of care and commitment we did when we started the company over thirty years ago. Our highly skilled specialists take the time to fully understand your business, then develop personalized, tailored solutions designed to anticipate your needs and help you scale.

Want to learn more? Email or give us a call! Our Payment Experts are here to give their insight and answer any questions you may have on merchant services.

A merchant account allows your business to accept credit and debit card payments in exchange for your product or service. GETTRX, as an acting Merchant Service Provider (MSP), assists you in your business operations by handling the responsibility of maintaining your processed payments within the federal/state regulations and depositing funds into your bank account. All backed by our industry leading customer service and hands-on risk protection departments.

All types of businesses can process their payments with GETTRX. Whether your business takes payments in-person, online, or needs the capability to split a transaction amongst accounts for your software, we have the right solution for you. GETTRX serves both low risk and high risk merchants.

For Retail and Restaurant (In-person payments) we have a two-hour turnaround for submitted applications with all the required documents. In special cases we can have any type of business accepting payments within 2 business days.

GETTRX’s merchants can see their funds deposited in their account after 2 banking days. Next Day Funding is offered for qualified merchants.

GETTRX Zero is the only way to offset part of, or eliminate entirely, your interchange fees.

GETTRX Zero is authorized across all 50 states following the compliance with the rules and regulations established by the Durbin amendment to the Dodd-Frank Wall Street Reform and Consumer Protection Act of 2010.

As a business owner all you pay is $29.00 per month. GETTRX Zero has saved merchants thousands of dollars. No transaction fees, no discount rate, no batch fees, no interchange and card brand fees, only the $29.00 per month. No PCI compliance fee only after providing free PCI compliance validation at the time of installation.

Whether you take payments at the counter or online, GETTRX allows for any type of business to benefit from GETTRX Zero.

Thousands of merchants across the country have switched over to cash discount programs; from hair salons to auto repair shops to companies that do business to business transactions. GETTRX Zero is the lowest priced of all the competitors’s Cash Discount Programs, but of course we have the traditional pricing plans to offer as a service. Your satisfaction is on the top of our list.

We supply our merchants with multiple channels to accept payments as needed for their business. This list includes, but is not limited to: Mobile Payments, In-Person and Contactless Payments, eCommerce Payments, Virtual Payments, APIs, and ACH.

Here at GETTRX we house the industry’s best Risk Management team to oversee all payment activities on your merchant account. Our team utilizes monitoring and alerting tools which provides observability 24-hours a day, 7-days a week.

Our online merchants have extended security through our gateway service, EdgePay. EdgePay’s token service allows you to request a token via API, user interface, or from EdgePay Pivot, our in-session, JavaScript method. This allows any merchant integrated with EdgePay to maintain PCI Compliant, by not storing any sensitive card data on their servers.

We offer a selection of terminal options for Contactless payments (e.g. Apple Pay or Google Pay) that allows you and your customers to make a card present transaction without the physical exchange.

Want to learn more? Email sales@gettrx.com or give us a call! Our Payment Experts are here to give their insight and answer any questions you may have on Contactless Payments.

GETTRX’s payment gateway EdgePay makes it quick, easy, and simple to create recurring payments. In our Processing Center, we provide your team with the capabilities to build new programs; add customers or contracts; add, modify, or delete payments; and view your customers’ history with one-click refund capabilities. We also provide you with alerts on declined transactions and expiring contracts.

If you run into an issue where your terminal is not able to accept a direct swipe or EMV payment, or just need to take a payment over the phone, rest assured you are able to manually enter a card payment on any one of our terminals.

Payment card industry compliance refers to the technical and operational standards that businesses follow to secure and protect credit card data provided by cardholders and transmitted through card processing transactions. PCI standards for compliance are developed and managed by the PCI Security Standards Council.

Tokenization is the process of protecting sensitive data by replacing it with an algorithmically generated number called a token. Often times tokenization is used to prevent credit card fraud. In credit card tokenization, the customer’s primary account number (PAN) is replaced with a series of randomly-generated numbers, which is called the “token.”

Point-to-Point Encryption (P2PE) is an encryption standard established by the Payment Card Industry (PCI) Security Standards Council. It requires that payment card data be encrypted immediately upon use with the merchant’s point-of-sale terminal and cannot be decrypted until securely transported to and processed by the payment processor.

P2PE prevents loss of cardholder data by keeping clear-text cardholder data from being present in a merchant or enterprise’s system or network where it could be accessible in the event of a data breach.

The purpose of a PCI-validated P2PE solution is to immediately encrypt cardholder data using the validated POI device, thus eliminating any clear-text cardholder data, which could be picked up by hackers

Our best in class payment gateway “EdgePay” has all the fraud detection, management, and mitigation tools you’ll need already built in so you can focus on running your business, while we eliminate the fraud.

We support all types of terminals: Mobile Terminal, Mobile POS, Countertops, PIN pads, Multilane, POS Integrations, and Kiosk/Unattended.

A payment gateway is a platform that allows you to process payments manually, online, or via API. The payment gateway works in the backend to encrypt and authorize a transaction so you can receive your payments for your product and service the same way as a standalone terminal. To learn more about GETTRX’s gateway, “EdgePay” visit edgepay.io.

Anytime a card holder reaches out to their credit card company to dispute a sale for one of your products or services, that is a chargeback. Our team will step in on your behalf to represent you in the chargeback dispute, talking directly to the issuing bank and we will request all the supporting documentation from you to defend your sale and fight for your profits.

Voiding “cancels” a sale, whereas a refund is a separate, offsetting negative sale. If possible, it’s always better to void rather than refund.

Global Electronic Technology approaches each customer relationship with the same degree of care and commitment we did when we started the company over thirty years ago.

Our highly skilled specialists take the time to fully understand your business then develop personalized, tailored solutions designed to anticipate your needs and help you scale.

When you combine this with our total offering, which includes our advanced cloud-based platform and the exceptional safety and security of our system, you will experience peace of mind and complete confidence knowing you have everything you need to be in control of your business.

Our Comprehensive Payment Platform Simplifies Merchant Reporting and Analytics While Giving You More Control Over…

You may be interested in accepting credit card payments for your small business but have…